Key features

$0 Monthly account keeping fee

There are no fees when you bank using this everyday account from ING.

Access free ATM withdrawals in Australia

When you meet the account conditions (deposit $1,000+ from an external source monthly and make 5+ card purchases a month) your first 5 ATM transaction charges will be rebated to you each month. ING will rebate you the ATM withdrawal fee and the ATM operator fee. After the first 5 ATM charges are rebated to you, standard ATM fees will apply.

When you meet these same conditions, you will also be rebated the ING International ATM withdrawal fee when you use an ATM overseas. Note however, that this rebate does not include the operator fee.

Earn 1% cashback on utility bills

You can earn 1% cashback on your eligible gas, electricity and water bill payments made from your Orange Everyday account using BPAY or Direct Debit (made using your BSB and account number only). This cashback offer is capped at $100 each financial year. To be eligible for the cashback offer you must meet the account conditions; deposit $1,000+ from an external source monthly and make 5+ card purchases a month.

Linked Visa Debit Card

Linked Visa Debit Card

You're issued a free Visa Debit Card to make purchases in stores, online and over the phone wherever Visa is accepted. There's no fees for transactions made in Australia.

Pay no international transaction fees

If you make an international purchase that involves converting currency to the Australian dollar (such as online shopping from overseas retailers), you won't be charged any international transaction fees so long as you deposit your pay of $1,000 monthly and make 5+ card purchases a month.

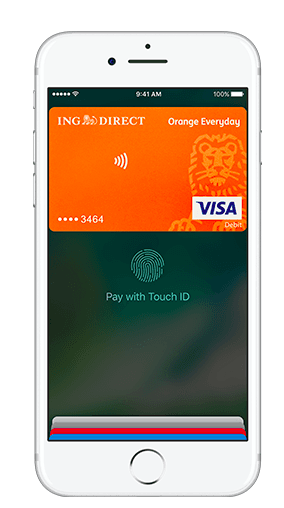

Apple Pay, Google Wallet available

You can use Apple Pay and Google Wallet with your ING Orange Everyday account, to make secure contactless payments with your smartphone, watch or wearable device. To set it up, open the Apple Pay or Google Wallet app on your phone and select the plus (+) sign. Then follow the prompts to add your ING debit card.

Electronic payments

You can take advantage of BPAY, Pay Anyone, EFTPOS, PayID and Bank@Post transactions for free. There are also no dishonour fees.

Secure chip technology

The Orange Everyday has a security chip which gives you extra security by making it hard for criminals to get access to your details. The Visa Zero Liability policy means whenever you press 'credit' when making a purchase at a store or over the telephone, or use payWave, you're not held responsible for fraudulent charges.

Branchless banking

It's worth nothing that ING is an online bank and therefore, doesn't have traditional branches. However, you have round the clock access to your account through the ING online banking portal, via ING's mobile app, ATM access with your Visa debit card along with phone banking with ING's 24/7 customer call centre. ING also has a lounge in the Sydney CBD where you can use ATMs, get advice and more.

What if I want to deposit cheques or cash into my account?

You can take advantage of Bank@Post outlets – these are Australia Post offices equipped with the facilities of a bank, so you can deposit your cheque or cash directly into your ING account for free.

Bonus interest on savings up to 5.5%

p.a. when you link with a ING Savings Maximiser

Earn 5.5%

p.a. on your ING Savings Maximiser balance when you link to an ING Orange Everyday account and meet the following criteria each month: deposit at least $1,000; make 5+ card purchases; and grow your Savings Maximiser balance (excluding interest earned). You can compare other ING products here.

Linked Visa Debit Card

Linked Visa Debit Card

Xuan

January 11, 2024

Hi, what should an international student apply for?