How to read your credit card statement

We get it. Your credit card statement can be tricky to understand. Here's a simple breakdown of the terms.

Checking your credit card statement is not the highlight of anyone's month, but it should still be done. In January 2021, Finder's Consumer Sentiment Tracker found that 17% of credit card holders admitted to not checking their statements at least once in that past year.

But it's important to understand how to read your credit card statement in order to keep track of your spending, make timely repayments, and flag any errors. Since most companies use a similar layout, we'll show you how to understand your credit card statement and what you need to pay attention to.

Key features on your credit card statement

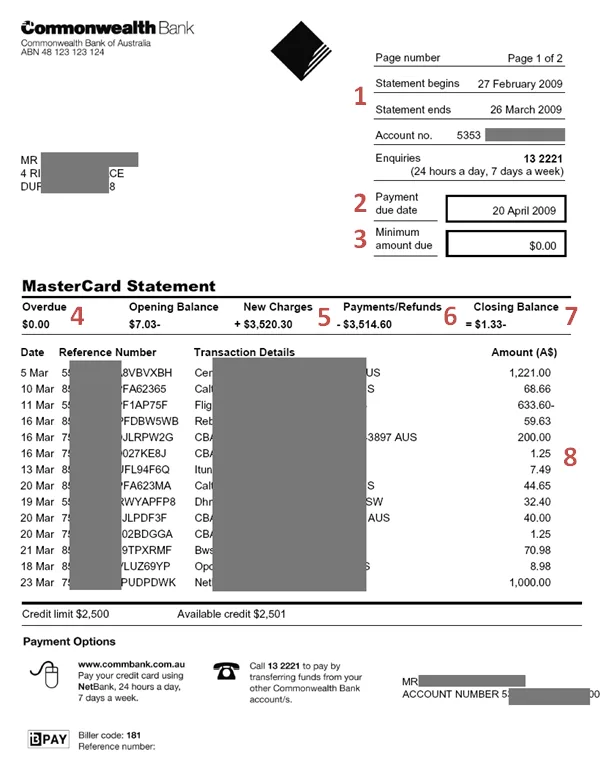

Below we've outlined the major features of a credit card statement. We've numbered each feature to match this example statement to help you find these details on your own paperwork.

1. The statement period

Your statement period is usually listed in the top right-hand corner of your statement. If you wish to make use of your card's interest-free days, understanding your statement period can help.

One common mistake many people make is assuming that interest-free days apply from the date of the purchase. While credit cards offer up to X number of interest-free days, the exact number of days depends on your statement cycle and when you make the purchase.

2. Payment due date

You can also find the payment due date on the top-right hand corner of your statement. This is the date you need to have made at least the minimum repayment by. You can pay the minimum or more before this date, but you'll be charged a late fee if you pay it after. Paying after your due date can also leave negative marks on your credit score, which could impact your chances of approval if you apply for another card in the future.

3. Minimum amount due

When using a credit card, you must pay a minimum amount each month. The minimum repayment is usually between 2-3% of your outstanding balance. Otherwise, a dollar amount between $10 and $30 may apply if the balance is larger.

4. Overdue

If you've paid your bill late or paid less than the minimum, the amount you're yet to repay will be detailed in the "overdue" section of your statement. The longer you have an overdue account, the more you'll be charged in late payment fees.

5. New charges

This is a summary of the total amount of money charged to the card during the statement period. Look at the new charges to make sure the total amount matches up with the transactions that you've made. This can help ensure there aren't any errors on your statement (such as fraudulent transactions or double charges).

6. Payments/Refunds

This is the total of all the payments made towards the card, along with any refunds, during the given statement period. Some refunds can take a few weeks to process.

7. Closing balance

This amount refers to how much you owe on your credit card account in total. If you pay more than you owe, this figure goes into negative. While you're only obligated to pay the minimum repayment each month, you should aim to pay as close to the closing balance as possible. If you pay the closing balance in full, you can avoid interest. You may also qualify for up to a certain number of interest-free days on purchases.

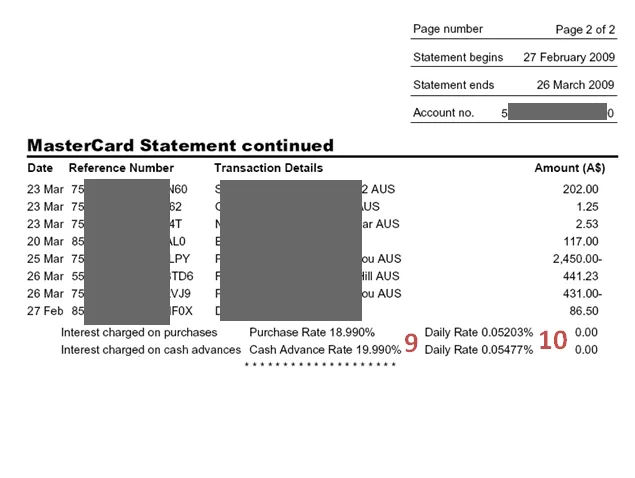

8. Transactions

This list will detail all of the transactions you've made on that card during that statement period. It should include the date of the transaction, its reference code, the type of transaction and the dollar amount.

9. Daily rate

While banks usually present the interest rate as an annual percentage, it's actually charged on your transactions on a daily basis. So you can use the daily rate to see how much your balance is collecting in interest each day, including your purchases, balance transfers and cash advances. Most transactions, aside from cash advances, usually don't start accruing interest until after the statement period ends, though.

10. Reward points

You can expect these details only if you use a rewards credit card or frequent flyer credit card. If you do, your statement should inform you of points earned during the statement period, the total number of points in your account, and points redeemed during this period. You can also monitor how many points you've earned through your online rewards program account and frequent flyer account balance.

How to manage errors on your credit card statement

While your credit card statement should usually be accurate, there are some instances where you might spot an error. If these errors go unreported, they could have a negative impact on your credit history and reduce your likelihood of approval when applying for future loans. This is why it's so important to keep an eye on your credit card statement.

If you do spot an error on your credit card statement, it's wise to get in contact with your card provider to report and resolve the issue. If you do this soon enough, the errors might not even make it to your credit file. The simple steps you can follow to report and fix an error on your statement include:

- If you spot a purchase you’ve not made, contact your card provider immediately.

- In some instances, the responsibility to prove you haven't made the purchase is on you, so make sure you have the relevant receipts and evidence on hand.

- If you feel you’ve been a victim of identity theft or if your card has been used for fraudulent transactions, you should also contact the police as well as your provider. See our guide on how to survive credit card fraud for more tips.

- If any such errors make it to your credit report, you’ll have to contact credit reporting bodies such as Experian, Dun and Bradstreet or Equifax individually to order a copy of your credit report. You can then get in touch with a credit repair agency to help clean up your credit report.

See our guide on how to lodge a credit card dispute with your bank for the contact details and steps you need to report an error on your credit card statement.

Get a free copy of your credit report here

Your credit card statement might seem like just another bill to deal with at the end of every statement period, but it's important to look over it rather than just paying your bill each month. Understanding how your statement works will not only ensure that you make timely repayments and avoid collecting interest, but will also help you spot any errors on your statement and resolve them before they impact your credit file.

Frequently asked questions

More guides on Finder

-

Finder Credit Card Report 2024

Finder's Credit Card Report investigates the emerging consumer behaviours and industry trends in Australia's credit card market.

-

Should you get a credit card?

The key benefits and risks to consider before taking out a credit card.

-

Australian credit card statistics

Discover exactly how the average Australian uses their credit card.

-

Credit cards for pensioners

Learn how to apply for a credit card when you're retired or on a pension and compare cards to find one that suits your needs.

-

Credit Card Surcharges

Compare the surcharges that you can expect when you pay with a credit card and pick up tips to avoid these extra fees.

-

You deserve the best credit card

While there isn't one best credit card, you can find a card that suits your needs by comparing the features, deals and offers that are trending here.

-

Horizon Bank Visa Credit Card

This low-cost card offers the same interest rate for all transactions and a $0 annual fee for life.

-

How long does it take to get a credit card?

From submitting the application and getting approval to receiving the card in the mail, here's how long it takes to get a new credit card.

-

Easy credit cards to get approval for

When you apply for a credit card online, you could receive a response within 60 seconds. Find out how you to find a card that you're eligible for and increase your chances of approval.

-

Custom credit card options in Australia

As well as credit card companies that let you choose your design, there are stickers and covers that you can get to customise your card.

Ask a Question

Hi, My Visa CC statement just arrived by post yet my online closing balance shows a lot less, which one should I pay?

Cheers, John

Hi John, thanks for your inquiry!

Your online statement will generally be the most accurate/ updated record and more reliable to pay to. It may be useful to check the payment records on the postal record and compare that to the online statement. There is a possibility that your credit card has had some pending or new transactions between the time your postal statement was mailed and when you have received it.

Cheers,

Jonathan

How can I know my credit card statement?

Hi Jaswant.

You will receive a statement a month after opening the account. If you want to keep track of purchases before a statement is sent out to you in the mail. You can check and manage your account online through your lender’s online banking facility.

Thanks for your question.

Do the things you purchase end up on your credit card statement?

Hi Christopher. Thanks for your question. Your credit card statement will show you all your transactions for the month. This includes purchases and cash advances. Statements come in the mail but you elect to receive them electronically. Jacob.

Is the opening balance the one you pay?

HI Marsha. Thanks for your question. You will need to pay all balances eventually if you want to get out of debt. But typically, the opening balance will have the card’s annual fee (if applicable) and any transactions you’ve made in the first month. You will need to make at least the minimum monthly repayment to stop your account from going in to arrears. Jacob.