In-store finance is traditionally offered through a store or company, particularly for big-ticket items such as furniture, electronics and jewellery. This type of finance usually gives you an interest-free period so that you can get what you want straight away and then pay it off in instalments over time or in full at a later date.

At JB Hi-Fi?

As well as finance offers you see in a particular store, there are some credit cards that provide in-store finance options, such as the Gem Visa and the GO Mastercard. Many stores also offer interest-free payment options through Afterpay, zipMoney, zipPay or other similar services. Here, we go through each of these options so that you can decide if an in-store finance offer is worth it for you.

How does in-store finance work?

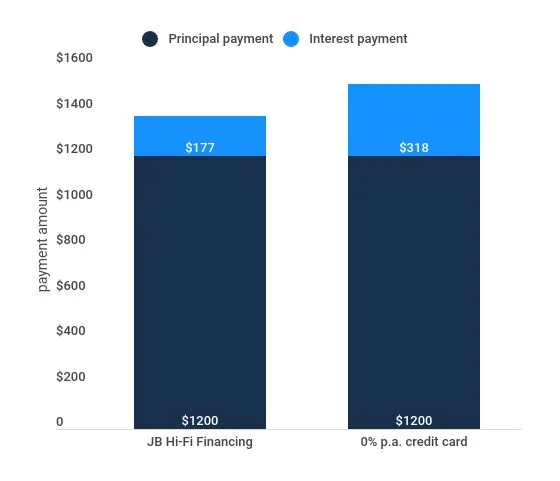

Imagine your laptop has just broken and you don’t have enough money to buy a new one. In this scenario, you shop around and find the laptop you want for $1,200 at a JB Hi-Fi store that has an interest-free payment plan available. You decide to weigh up two options: get a 30-month interest-free plan directly through JB Hi-Fi, or purchase the laptop on a credit card that offers 0% p.a. on purchases for 12 months.

- In-store finance plan: In this scenario, JB Hi-Fi’s interest-free financing offer gives you 30 months interest-free. During the first 20 months, you would have to pay a minimum of 3% of the outstanding balance per month. The minimum payment then changes to $20 per month for the remaining 10 months. After that, interest begins to accrue at 25.99% p.a.

- If you only made the minimum payment, it would take 5 years and 2 months to pay off the laptop. This is a total of 62 months, meaning you’d be charged interest for more than half the time you were paying off the laptop.

- 0% purchase rate credit card: Say you get a card that offers 0% interest for the first 12 months and has a minimum payment of $30 per month. After the introductory period, interest would accrue at 20.74% p.a.

- If you continued to make only the minimum payment, it would take 4 years and 3 months to pay off the laptop. This is a total of 51 months, which means you’d be charged interest for over 75% of the time you were paying off the laptop.

This graph shows that the JB Hi-Fi in-store finance option attracts the least interest, even though it would take longer to pay off the laptop when compared to using the credit card. The best course of action, however, is to make more than the minimum repayment so you can pay off your purchase before the interest-free period is over.

Who is in-store finance designed for?

In-store finance is offered to people who may not have enough cash to pay for something outright, or who want the flexibility to pay off purchases over time. For example, if you needed a new fridge but couldn’t afford the one that you wanted, you could consider one of these interest-free payment plans as a solution.

In-store finance options typically give you a set period of time when you can pay off your purchase without any interest charges – as long as you meet the repayment requirements. This could mean making minimum monthly payments towards the purchase, or providing the full amount owed at the end of a fixed period of time.

If you don’t meet the offer’s requirements, you’ll usually face additional fees and/or interest charges until the balance is cleared. As in-store finance offers vary a lot, it is important that you carefully read through the offer details before you apply.

Types of in-store finance options

Depending on your purchase, you’ll usually be able to get either of the following flexible payment options:

- Instalment plans. With these offers you can get the item you want straight away and are then required to pay it off in instalments. Some of these plans divide the payments into equal instalments (eg $200 per month) while others have a minimum payment amount you must meet. You may also have the option of paying more if you want to settle the balance sooner.

- Buy now, pay later. Also known as a deferred payment option, this type of plan requires payment in full at the end of the interest-free period. While these plans don’t usually require a deposit, you may have to pay a credit establishment fee or an annual fee once the plan is set up.

Regardless of the type of offer, you will usually need to meet a minimum spend requirement before you're eligible for an in-store finance offer. A deposit or establishment fee may also apply if you are approved.

In-store finance and your credit history

It’s important to note that many of these plans are set up as credit accounts, meaning you will need to fill in an application that is subject to lending criteria and approval.

Your credit history and credit score can have an impact on your application, so if you’re not sure what details are currently listed, you can check your credit score for free online at any time. Another key point to remember: after you submit an application, the details will be added to your credit history and could also affect your credit score.

Finder survey: Do Australians know what the interest rate will be when their card's 0% period ends?

Source: Finder survey by Pure Profile of 1113 Australians, December 2023

Credit cards that offer in-store finance options

There is a small selection of credit cards that regularly give you access to in-store finance offers. The plans available vary depending on the card and participating retailers, but they typically offer you longer interest-free periods than you would get for regular purchases made on the card.

Below are some examples of the types of offers available on specific credit cards:

- Latitude’s Gem Visa and Go Mastercard offer a range of 0% payment plans with participating retailers around Australia.

If you have one of these credit card and want to take advantage of an in-store finance offer, let the store’s staff know before you pay for your purchases. They can then explain the requirements and set up the payment plan. Alternatively, you could call your credit card company and ask about the requirements before you go shopping.

Interest-free payment plans that are linked to a credit card

Some retailers offer interest-free payment plans that come with a credit card or give you the option of getting a credit card when you apply for finance. For example, The Good Guys has partnered with the Gem Visa for one of its in-store finance options, while Flight Centre and IKEA both offer interest-free finance options linked to a humm Card credit facility.

Often these cards have high standard interest rates that apply when the promotional period ends, so it’s important to check the rates, fees and other offer details before you apply.

How long does it take to get in-store finance through a credit card?

It does vary but with some cards, it's possible to apply in-store, get a response within 60 seconds and then use the card straight away.

For example, if you're shopping at The Good Guys, Apple or another store that offers finance through the Gem Visa credit card, you can start using it as soon as you're approved. You just need to set it up through the Latitude app and add it to a mobile wallet.The actual card will then arrive in the mail in around 5-10 business days.

You'll find a similar option if you're applying for interest-free finance through the humm90 Mastercard, which offers a digital credit card you can use once you're approved. The physical card then takes 5-7 working days to arrive in the mail.

What about other options?

Ultimately, with any form of in-store finance, the time it takes before you can use it will depend on factors including:

- The store where you're shopping

- The specific credit card or in-store finance offer

- Your financial circumstances

In some cases, it could also include what you're buying if, say, the interest-free offer is only available for certain products or purchase categories.

Your application could also be held up if the credit card issuer asks you to provide further details. And, worst case, your application could be declined.

So, before you apply for interest-free finance at any store, ask how long it will take to apply and when you can start shopping. It's also worth checking to see what type of account the finance is linked to and whether there are any other fees, as most credit cards offering in-store finance do attract annual fees.

What other options do I have to shop interest-free?

Credit cards that offer long interest-free periods

If you have a few purchases to make and need some flexibility to pay them all off, you could consider getting an interest free credit card that offers 0% p.a. on purchases for an introductory period. Depending on the card, this could give you up to 14 months when you can make purchases without paying interest (as long as you pay at least the minimum amount listed on each statement).

Alternatively, you could consider a card that offers instalment plans with a reduced or 0% p.a. interest rate. For example, the humm90 Mastercard offers interest-free instalment plans of 9, 12, or 15 months when you spend at least $250, while Citi may offer cardholders Fixed Payment Options with a promotional interest rate on eligible new purchases over $500. You can learn more about how instalment plans work in our full guide.

Interest-free platforms and providers

Platforms such as Zip Money, Zip Pay and Afterpay have changed the way many people shop by offering a "modern lay-by". For example, Afterpay lets you shop online or in-store and then spread the cost of your purchase out into four equal instalments that are paid fortnightly.

Zip Pay, on the other hand offers you a credit limit of $350, $500 or $1,000 that you can use for shopping online or in-store. You then have up to 60 days to pay off what you spend without fees. Check out our guide to buy now pay later to learn more about how these services work and compare other options.

What to ask before getting in-store finance

If you’re thinking about applying for an interest-free payment plan, make sure you ask the following questions:

- What upfront costs are involved? Check for minimum spend requirements, establishment fees, annual account costs and any charges that may apply if you want to settle the balance before the end of the agreement.

- What charges apply at the end of the interest-free period? Most in-store finance options charge high interest rates if you’re still paying off your purchase when the interest-free period ends. Others may apply ongoing account fees at the end of your term instead. Either way, these costs can quickly add up.

- What type of account is being opened? Some in-store finance options are linked to a credit card, others offer an ongoing credit facility and some are closed as soon as your balance is settled. Make sure you think about the type of account you want – and avoid getting any account that would be hard for you to manage.

- Will the account be listed on my credit history? Any account details or enquiries that are added to your credit file have the potential to impact on your credit rating (and your ability to get other loans or products). Not all in-store and interest-free finance options are automatically listed, but it is worth checking when you’re comparing options so you can be aware of the potential impact.

- Do I need to make this purchase right now? If you urgently need something, an interest-free finance plan could give you the breathing space to pay it off over time. But if it’s not urgent, you may want to consider other options, such as saving up for it or splitting the payment between a couple of your existing accounts. Another option is to get a lay-by plan, where you pay for an item in instalments but don’t get it until you make the final payment.

Whether you’re shopping for furniture, booking a holiday or need a new laptop, in-store finance gives you another way to make your purchase and pay it off over time. But watch out for rates and fees that can apply at the start and end of these offers, and make sure you look at other options so that you can make a decision that’s affordable for you.

Images: Shutterstock

Back to top